#ThotAudit: People Are Reporting Snapchat Camgirls to The IRS

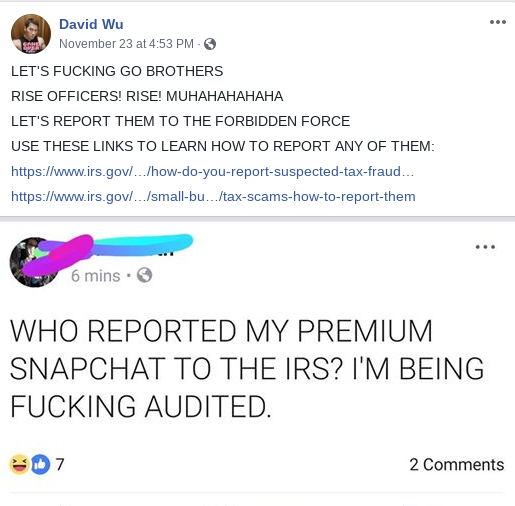

A man named David Wu is leading a very young campaign (only a few days old) against Snapchat camgirls by reporting them to the IRS (or so they claim).

This campaign is targeting “thots” (a slang term and acronym for “That Hoe Over There”), who post nude photos of themselves to their Snapchat accounts, and then accept money in return for the ability to access the account photos.

The campaign is reporting these women to the IRS for (possibly) not reporting payments sent to them as income on their tax forms.

To formally report someone to the IRS, an individual would need to submit form 3949-A to the IRS. This form (image below) asks for personal information that a stranger would have no way of knowing if it was not posted online by the person being reported, including street address, email, and Social Security Number. The form does state “Leave blank any lines you do not know.” which suggests that this information is not necessarily required for the report to be accepted and legitimate. Regardless, it’s still not clear if the IRS will accept these forms without direct evidence of tax fraud.

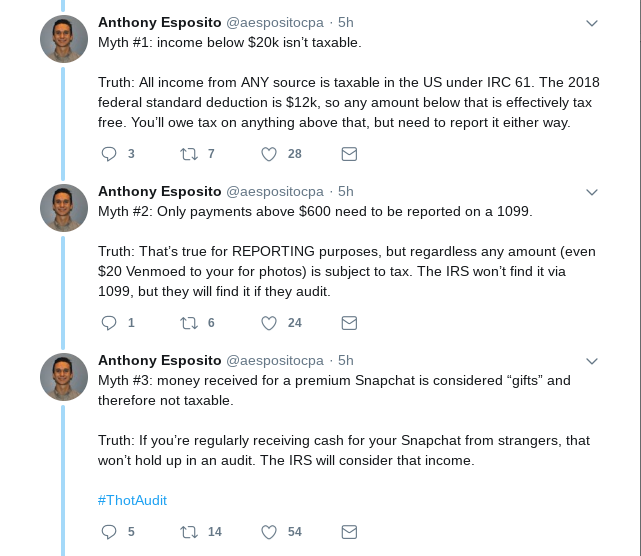

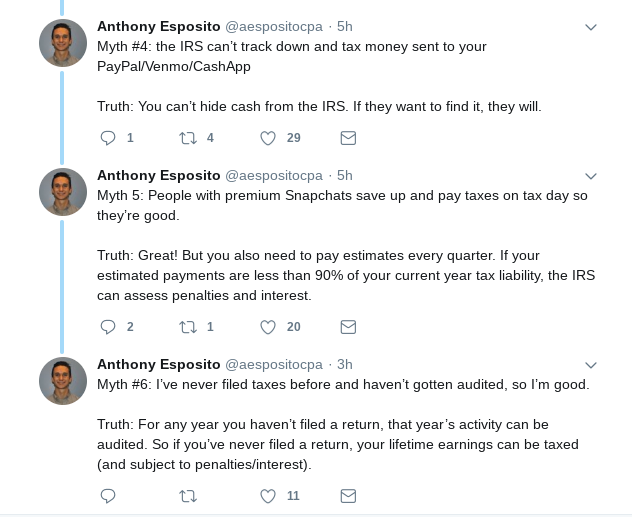

Accountant and Twitter user @aespocitocpa has dispelled some myths arising recently in regards to this campaign.